Turn Your Homeownership Dreams into Reality

Fuel Business Growth with Flexible Lending Solutions

Loan Calculator

Calculate payments for mortgages and business loans

Monthly Payment

Principal & Interest

Property Tax

Home Insurance

PMI

Loan Summary

Overview

Mortgage Services

We specialize in helping you navigate the world of home loans with ease. Whether you're a first-time homebuyer, looking to refinance, or ready to invest in real estate, our mortgage experts are here to guide you, offering personalized service and competitive rates.

Business Lending Services

We partner with top lenders to provide fast and reliable funding for small businesses, trucking companies, contractors, and investors. Whether you need working capital, new equipment, or a line of credit, we can help you secure the right financing.

Mortgage Solutions

FHA Loans: Government-backed loans ideal for first-time homebuyers or those with lower credit scores.

VA Loans: Special loan options for veterans and active-duty military, offering favorable terms and no down payment.

Conventional Loans: Fixed-rate and adjustable-rate loans with competitive terms for those with solid credit.

Bank Statement Loans: Ideal for self-employed individuals, this loan is based on your bank statements rather than tax returns.

Investment Property Loans: Tailored financing options for real estate investors looking to purchase or refinance rental properties.

First-Time Homebuyer Programs: Specialized programs to make homeownership more accessible for first-time buyers.

Refinance Options: Refinance your current mortgage to secure a better rate or cash out equity for home improvements.

Business Lending Solutions

Working Capital Loans – Fast access for daily operations, inventory, and growth. Flexible 3–84 month terms.

Equipment Financing – New or used equipment, up to $10MM approvals, minimal down payment.

Lines of Credit – Revolving lines up to $750K with automatic replenishment.

SBA Loans – Government-backed, favorable terms, lower down payments.

Fix & Flip Loans – Up to 100% purchase + rehab costs, interest-only available.

Bridge Loans – Short-term gap financing; quick approvals.

Commercial Real Estate – Purchase, refinance, or cash-out for DSCR & rental income.

Transportation Loans – Fleet financing for trucking, logistics, and commercial vehicles.

Why Choose Baz State?

At Baz State, we’re more than a lender — we’re your long-term financial partner. Whether you’re buying your first home, refinancing, or funding your business growth, we deliver the right solution with speed, transparency, and personalized care

Get In Touch

Email: 📧 [email protected]

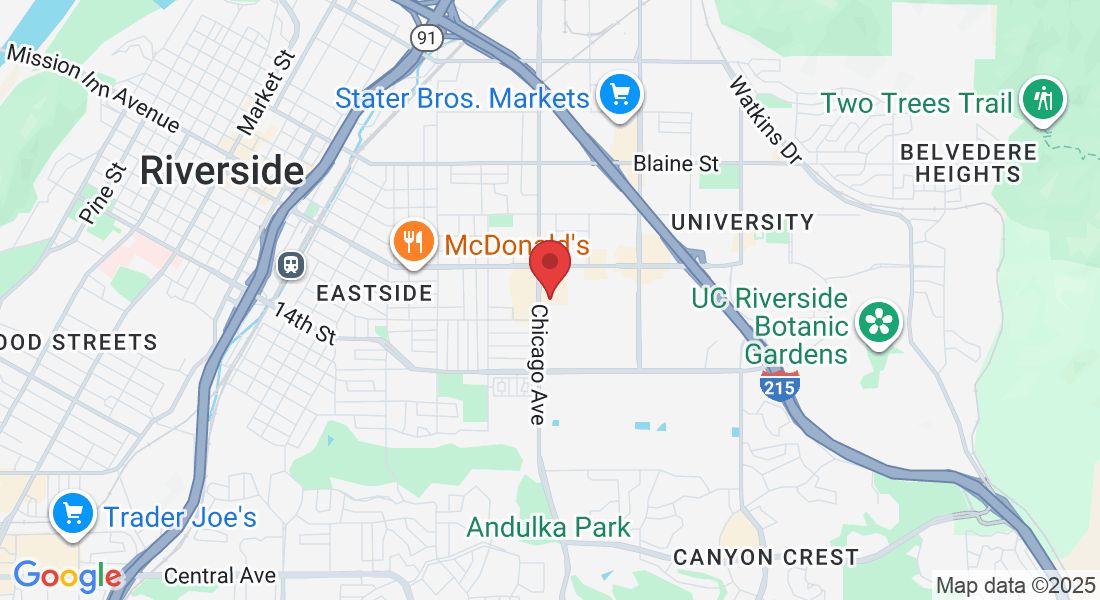

Business Address: 4020 CHICAGO AVE # 13 RIVERSIDE, CA 92507

Mon–Sat: 9am–6pm,

Frequently Asked Questions

How long does it take to get pre-approved for a mortgage?

Typically, pre-approval takes 24-48 hours. We’ll need a few basic details from you, such as income, credit score, and property type.

What is the minimum credit score needed for a mortgage?

Credit score requirements depend on the loan type. For example, FHA loans may accept scores as low as 580, while conventional loans typically require a score of at least 620.

Do you offer loan options for self-employed individuals?

Yes! We offer Bank Statement Loans, which allow self-employed individuals to qualify based on bank statements instead of tax returns.

What are the benefits of an FHA loan?

FHA loans typically require a lower down payment (as low as 3.5%) and are more forgiving with credit scores, making them ideal for first-time homebuyers.

How much of a down payment do I need for a mortgage?

The required down payment varies based on the loan type. Conventional loans often require at least 5-20%, while FHA loans may require as little as 3.5%.

How fast can I receive funding?

Working capital and revenue-based loans can fund in 24–48 hours; SBA and CRE loans may take longer.

What documents are required?

Typically 3–6 months bank statements, a driver’s license, and a voided business check. Additional documents may be requested for SBA or equipment loans.

What industries do you serve?

Trucking, construction, contractors, real estate investors, restaurants, retail, and more.

How much can I borrow?

Funding amounts range from $10,000 to $10 million, depending on program and qualifications.